- The Onveston Letter

- Posts

- Lobbying: The Crystal Ball for Smart Stock Pickers?

Lobbying: The Crystal Ball for Smart Stock Pickers?

Are You Missing Out on Crucial Stock Intel?

Welcome - and thank you for signing up for The Onveston Letter!

Dear Investor,

Every stock's long-term performance boils down to how efficiently a company uses its money to generate returns. Better use of capital leads to better returns.

Companies spend on various strategies, like advertising, to boost their brand. Take Coca-Cola - their decades-long ad campaigns are a clear sign that this investment pays off.

This got me thinking: What's an alternative spending method that's been around for decades, offers companies huge benefits, and happens right under our noses while staying mostly unnoticed?

The answer is corporate lobbying.

Unlike flashy ad campaigns, lobbying works behind the scenes, influencing policies and regulations that can dramatically impact a company's bottom line.

“Lobbying describes paid activity in which special interest groups hire well-connected professional advocates, often lawyers, to argue for specific legislation in decision-making bodies such as the United States Congress. It is often perceived negatively by journalists and the American public; critics consider it to be a form of bribery, influence peddling, and/or extortion.”

- Wikipedia -

This picture explains it better:

While it may seem like a background activity, its effects on a company's bottom line can be big. As government policies increasingly shape the business landscape, companies that effectively lobby can gain a competitive edge.

Consider for a moment the changing political climate over the past two decades. Major regulatory and legislative actions have had far-reaching consequences for various sectors of the economy.

From financial reforms to tax cuts, tariffs, and infrastructure bills, government policies have created both opportunities and challenges for businesses.

In this environment, companies that can navigate the political landscape stand to benefit greatly.

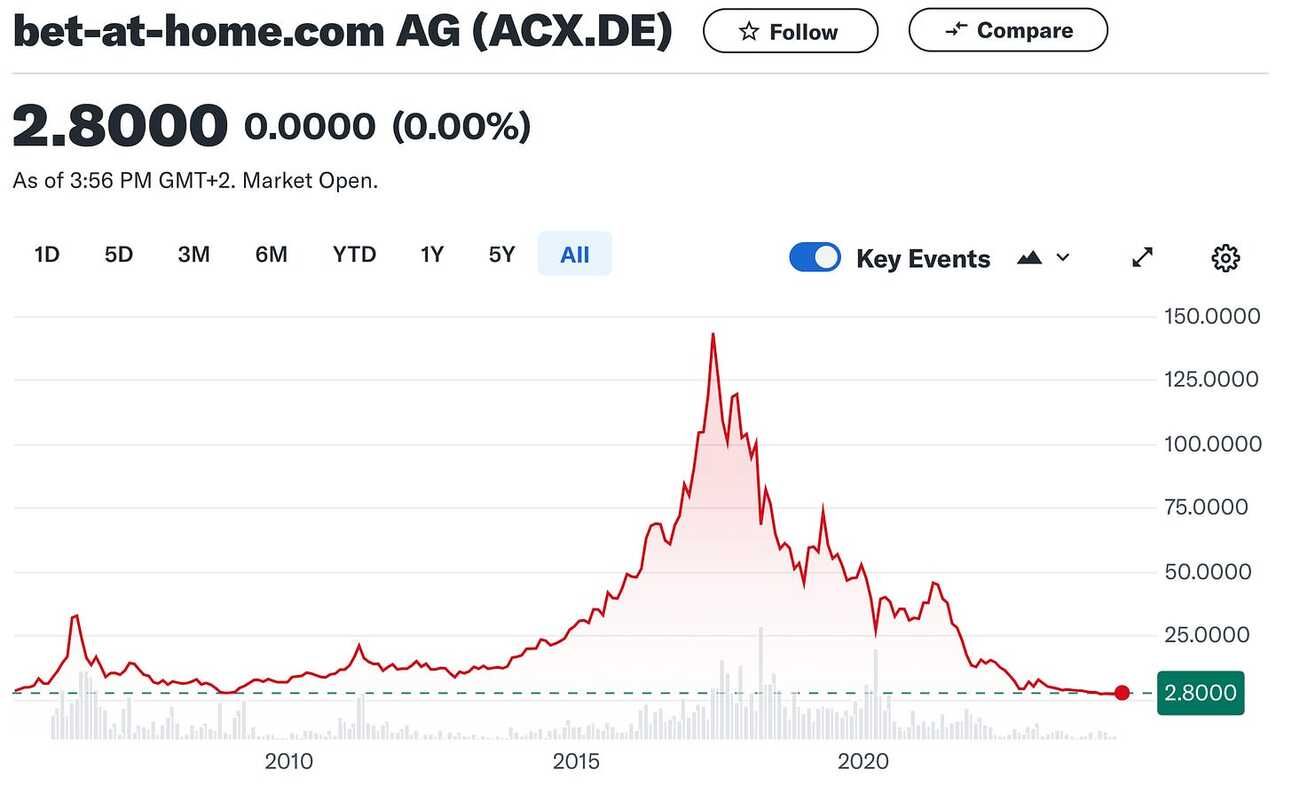

But government policies also pose risks to companies. I once invested in a European online gambling firm with a promising growth story.

Their business model was “being the guy who takes a cut” from sports gamblers. The free cash flow was insane due to the low-cost business model of a gambling website and the scalability.

However, a new EU policy soon blocked them from operating in an important market. This single regulatory change devastated the company's prospects, forcing me to sell my position shortly after.

Years later, the firm still hasn't recovered from this setback. You can probably guess when the law was passed:

How Effective is Corporate Lobbying?

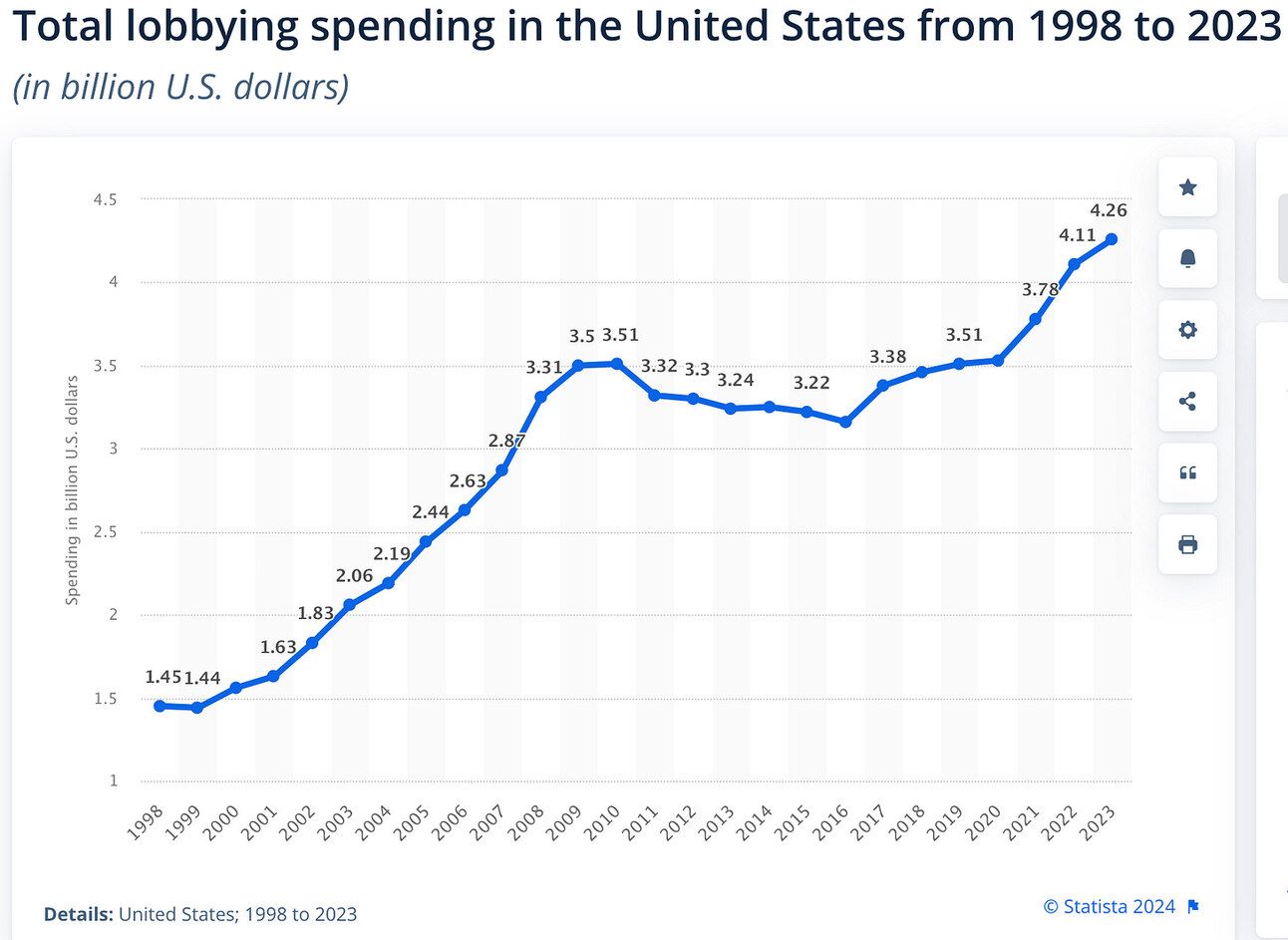

The effectiveness is difficult to quantify precisely, as it's just one aspect of a company's overall strategy and varies by industry. However, the continuous growth in lobbying expenditures suggests it's a worthwhile investment for businesses.

In the United States, total lobbying spending has surged from $1.45 billion in 1998 to $4.26 billion in 2023. This represents a 193% increase over 25 years, or a compound annual growth rate of about 4.4%.

Most corporations aren't in the habit of throwing money away. The sustained increase in lobbying expenditures indicates that companies see tangible benefits from these activities, whether in favorable legislation, regulatory advantages, or other policy outcomes that positively impact their bottom line.

Despite its significant role in maintaining or creating economic moats, corporate lobbying is an expense that traditional equity analysis often overlooks.

Once again you see that investing requires some degree of creativity to figure out ways to get information that’s not utilized by the masses.

Let's examine the potential returns using lobbying expenditure as a selection criterion. While we can't precisely measure the return on each dollar spent, we can indirectly see its impact by analyzing the stock performance of the top lobbying spenders.

The Lobbying Disclosure Act of 1995 requires lobbyists in the United States to disclose information about their activities, such as their clients, which issues they are lobbying on, and how much they are being paid.

The Biggest Spenders and Their Stock Performance

We're going to create a portfolio of the 10 public companies with the highest reported lobbying expenditures in the past quarter. Each company will have an equal weighting in the portfolio, and we'll rebalance monthly to maintain this equal distribution and reflect the most current lobbying data.

By rebalancing monthly, we ensure our portfolio consistently reflects the most active lobbyists.

The starting date is the 1st of March in 2009 until today.

Here are the results:

CAGR +15.71%

Max Drawdown -31.50%

Beta 0.91 (below 1 means the portfolio is less volatile than the market)

Number of trades: 1654

Win Rate: 79.30%

Overall, this strategy deserves more attention. We're using just one factor - lobbying spending - to select stocks, and despite this straightforward approach, the performance is notable.

It suggests that lobbying expenditures might be a better indicator of stock performance than many investors realize. This shows once again the value of using non-traditional metrics when screening for stocks.

Final Thoughts

Lobbying allows companies to have a voice in shaping policies that affect their operations. It can help secure favorable regulations, protect market share, or even disadvantage competitors.

Recognize the influence of corporate lobbying on policy and business outcomes.

Consider lobbying activities as part of your investment research process.

Look beyond traditional financial metrics to gain a fuller picture of a company's strategic positioning.

Stay informed about policy changes that could impact various industries and companies.

Remember that while lobbying can provide insights, it's just one of many factors to consider when analyzing companies.

Moreover, lobbying activities can serve as an indicator of emerging trends and issues in various industries. As companies shift their lobbying focus to address new challenges or opportunities, smart investors can spot potential catalysts for growth or decline before they become widely recognized.

“Experts” won’t tell you this.

But I will. 🥂

In this spirit, I wish you a pleasant week. Until the next issue 👋

P.S.: Next week I will publish the first stock analysis. Stay tuned!

Appreciate my unique take on stock investing? Consider donating the price of a coffee to keep these insights coming:

If you enjoy The Onveston Letter, let me know by clicking the “Like” button ❤️.

And if you aren’t a subscriber yet, then sign up below to not miss out on future articles.

For new readers: Check out all my previous posts here

Disclaimer: This analysis is not advice to buy or sell this or any stock; it is just pointing out an objective observation of unique patterns that developed from my research. Nothing herein should be construed as an offer to buy or sell securities or to give individual investment advice.

Reply