- The Onveston Letter

- Posts

- How People Invested Before The Internet Was A Thing

How People Invested Before The Internet Was A Thing

And what we can learn from it

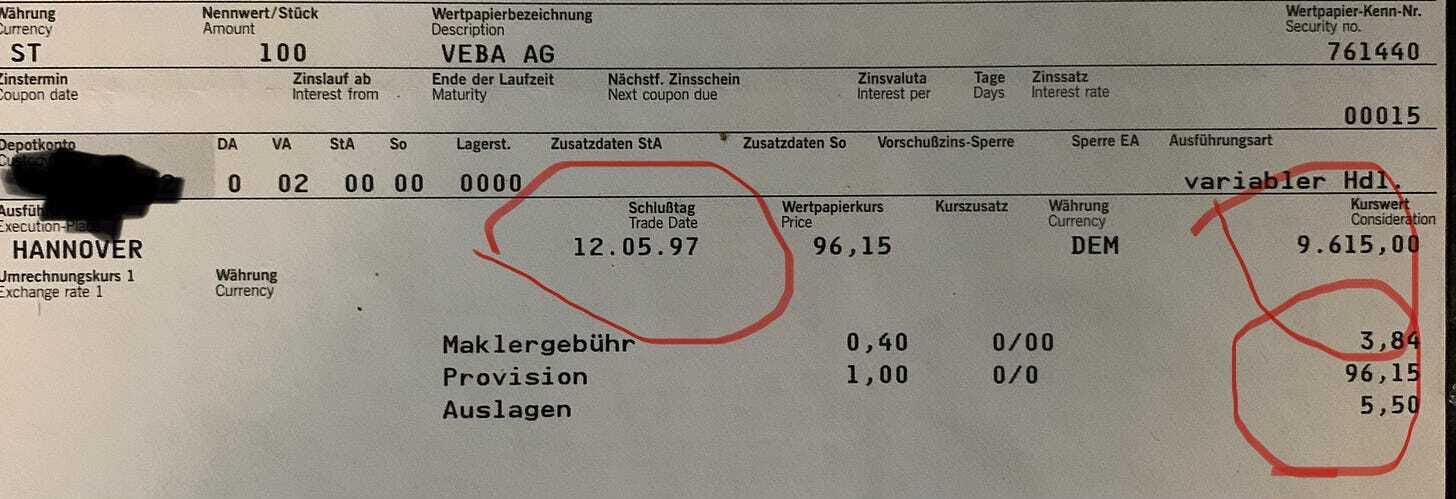

I was cleaning my basement recently and found this old buy order from the 90s:

Even though I was just a kid back then, I remember how different investing was for regular people. We have so many advantages today that we don't even think about.

Let me tell you what investing was like for retail investors before the internet changed everything.

Order Execution and Market Access

The mechanics of placing trades in the 1990s required either phone calls to brokers or primitive online interfaces that were slow, unreliable, and limited in functionality.

Most retail investors still called their brokers, which introduced delays, potential miscommunication, and additional pressure to make quick decisions while on the phone.

Even when online trading platforms began emerging in the mid-1990s, they were often unstable during volatile market periods, exactly when investors needed reliable access.

Market access was also limited. After-hours trading was virtually non-existent for retail investors, and international markets were difficult and expensive to access.

The concept of fractional share ownership didn't exist, meaning investors with limited capital couldn't invest in high-priced stocks.

The Costs

Perhaps the most dramatic difference lies in trading costs. In the 1990s, trade commissions had widely dropped to ≈ $50 which was actually considered a significant improvement from the even higher fees of earlier decades.

To understand the magnitude of this, consider that a typical retail investor making ten trades per year would pay ≈ $500 in commissions alone, not accounting for bid-ask spreads and other hidden costs.

For smaller accounts, these fees could easily consume a few percent of an investor's portfolio annually, creating a substantial drag on returns that made frequent trading too expensive for most retail investors.

The Research

The 90s retail investor operated in an environment of severe information disadvantage. Professional research was largely the domain of institutional investors and wealthy individuals who could afford premium services.

Most retail investors relied on newspaper financial sections, monthly magazines like Money or Forbes, and basic broker reports that often arrived days or weeks after institutional investors had already acted on the same information.

Real-time market data was expensive and difficult to access. Level II quotes for example, which show market depth and pending orders, were practically unavailable to retail investors.

Even basic delayed quotes often required special arrangements with brokers or costly data subscriptions.

This meant that retail investors were essentially investing blind, making decisions based on yesterday's closing prices while institutions operated with real-time information advantages.

The research tools available were primitive by today's standards. Financial websites were in their infancy, with basic sites like Yahoo Finance just beginning to emerge in the mid-1990s.

Complex financial modeling, backtesting capabilities, and sophisticated screening tools were available only to professional investors with expensive Bloomberg terminals or similar institutional platforms.

Looking at this, it makes perfect sense why people thought they could value tech companies just by counting website visitors.

Investment Strategy Limitations

The range of available investment strategies for retail investors in the 1990s was remarkably narrow compared to today.

Index funds existed but were not yet mainstream, with most investors limited to actively managed mutual funds with high expense ratios, often exceeding 1-2% annually.

ETFs were introduced in 1993 with the SPDR S&P 500 ETF, but the selection was minimal and adoption was slow.

Options trading was available but expensive, with high minimum account requirements and limited educational resources.

Complex strategies like covered calls or protective puts were typically beyond the reach of average retail investors due to both cost and complexity barriers.

Derivatives, alternative investments, and sophisticated hedging strategies were essentially institutional-only products.

International diversification was difficult and expensive, often requiring specialized international funds with high fees and limited transparency.

Currency hedging was not typically available to retail investors, and emerging market access was extremely limited.

Final Thoughts

Today's retail investors have access to research capabilities that would have been envied by professional analysts in the 1990s.

Modern platforms provide real-time financial data, advanced charting tools, earnings estimates, institutional ownership data, and sophisticated screening capabilities - all typically available at no additional cost.

Social sentiment analysis, insider trading tracking, and algorithmic trading signals are now commonplace tools for retail investors.

The quality and depth of freely available analysis has improved dramatically. Detailed earnings transcripts, SEC filings, and corporate presentations are instantly accessible.

The speed of execution has improved from minutes or hours to milliseconds.

Advanced order types like stop-losses, trailing stops, and bracket orders are standard features rather than premium services.

Mobile trading apps enable investment management from anywhere, a concept that would have seemed like science fiction to 90s investors.

The abundance of information and tools, while generally beneficial, has also created new challenges.

The paradox of choice can overwhelm new investors, and the constant stream of market information can encourage reactive rather than strategic thinking.

Social media influence on investment decisions represents an entirely new dynamic that didn't exist in the 90s.

While retail investors have gained tremendous capabilities, institutional investors have also advanced significantly.

High-frequency trading, advanced algorithms, and massive data processing capabilities have given institutions new advantages even as retail access has improved.

The playing field has been elevated for everyone, but whether it has been truly leveled remains a subject of a different debate.

What once required significant wealth, specialized knowledge, and professional relationships is now accessible to anyone with a smartphone and internet connection.

As tough as retail investing was in the 90s compared to today, there was one huge advantage:

You had to hold your stocks and wait.

You couldn't get caught up in constant trading because there was no smartphone to check news every five minutes, and you didn't have time to sit in front of the TV all day.

All you could do was buy and hold.

And I think we've lost something important there.

Until the next issue.

☕ Enjoying these insights? If my articles help you make smarter investments, consider buying me a coffee. It’s a small way to support the work and keep these ideas coming. 👉 Buy me a coffee 👈

Want to Invest in Companies That Truly Matter?

I buy individual stocks for my own portfolio and I analyze individual stocks for my clients.

Elite companies with elite management and unique products are the ones that perform the best - all you have to do is give them some time.

Every few weeks, I introduce a handpicked stock that stands out for its strong fundamentals, competitive moat, and growth potential.

Backed by in-depth analysis, each recommendation is carefully chosen to help you build wealth sustainably over time.

Don’t just follow the market - get ahead of it with strategies tailored for serious, patient investors who seek consistent, long-term success.

Start building a portfolio of elite businesses step by step - while Wall Street lemmings follow the crowd.

If this resonates with you, then get the last 4 reports today and gain the edge you need during uncertain times.

Remember: The next crisis is inevitable. But panic is optional. Arm yourself with businesses designed to endure - then sit back, sip your coffee, and let time prove you right.

If you enjoy The Onveston Letter, let me and the algorithm know by clicking the “Like” button ❤️.

And if you aren’t a subscriber yet, then sign up below to not miss out on future articles.

For new readers: Check out all my previous posts here

Disclaimer: This analysis is not advice to buy or sell this or any stock; it is just pointing out an objective observation of unique patterns that developed from my research. Nothing herein should be construed as an offer to buy or sell securities or to give individual investment advice.

Reply